All Categories

Featured

Table of Contents

Juvenile insurance might be offered with a payor benefit motorcyclist, which offers forgoing future premiums on the child's plan in case of the fatality of the person that pays the costs. what does the term illustration mean when used in the phrase life insurance policy illustration. Senior life insurance, occasionally referred to as rated fatality benefit plans, provides qualified older applicants with very little whole life insurance coverage without a medical exam

The allowable concern ages for this type of insurance coverage range from ages 50 75. The maximum issue amount of insurance coverage is $25,000. These policies are generally more pricey than a completely underwritten policy if the person qualifies as a common risk. This kind of coverage is for a little face amount, typically bought to pay the burial expenses of the insured.

You choose to obtain one year of extremely inexpensive coverage so you can choose if you want to dedicate to a longer-term plan.

The Federal Federal government established the Federal Personnel' Group Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the largest team life insurance policy program in the world, covering over 4 million Federal staff members and retirees, along with numerous of their household members. Most workers are eligible for FEGLI insurance coverage.

Best Decreasing Term Life Insurance

It does not construct up any type of money worth or paid-up value. It includes Fundamental life insurance policy coverage and three choices. If you are a new Federal employee, you are automatically covered by Fundamental life insurance coverage and your payroll workplace deducts premiums from your income unless you forgo the coverage.

You have to have Fundamental insurance in order to elect any of the options. Unlike Standard, enrollment in Optional insurance coverage is not automated-- you must take activity to elect the options. The price of Fundamental insurance policy is shared in between you and the Government. You pay 2/3 of the complete cost and the Federal government pays 1/3.

You pay the full expense of Optional insurance, and the price depends on your age. The Office of Federal Personnel' Team Life Insurance Coverage (OFEGLI), which is a personal entity that has an agreement with the Federal Federal government, procedures and pays insurance claims under the FEGLI Program.

Term life insurance is a type of life insurance that provides coverage for a specific duration, or term, chosen by the insurance holder. It's usually the most straightforward and budget-friendly life insurance choice by covering you for a set "term" (life insurance policy terms are typically 10 to thirty years). If you die during the term period, your recipients get a money settlement, called a death advantage.

Term life insurance policy is a straightforward and economical service for individuals looking for budget-friendly defense throughout certain durations of their lives. It is very important for people to very carefully consider their financial objectives and needs when choosing the period and amount of coverage that best suits their conditions. That said, there are a few reasons that several people pick to obtain a term life policy.

This makes it an attractive alternative for individuals that desire substantial protection at a lower cost, especially throughout times of greater monetary duty. The other key advantage is that costs for term life insurance policy plans are dealt with for the period of the term. This implies that the policyholder pays the exact same premium amount yearly, supplying predictability for budgeting functions.

Can I Transfer My Term Life Insurance Policy To Another Company

1 Life Insurance Policy Stats, Information And Market Trends 2024. 2 Expense of insurance coverage rates are figured out using methods that differ by firm. These prices can vary and will generally increase with age. Prices for active employees might be different than those readily available to ended or retired staff members. It is very important to consider all aspects when examining the overall competitiveness of rates and the value of life insurance policy coverage.

Absolutely nothing in these products is intended to be suggestions for a certain situation or person. Please seek advice from your own advisors for such advice. Like the majority of team insurance policies, insurance plan offered by MetLife contain specific exclusions, exceptions, waiting periods, reductions, constraints and terms for keeping them active. Please call your advantages manager or MetLife for prices and complete details.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year plans. One of the most preferred kind is level term, meaning your settlement (costs) and payout (death advantage) stays degree, or the very same, till the end of the term period. This is one of the most simple of life insurance policy choices and requires very little upkeep for plan proprietors.

You might give 50% to your spouse and split the remainder amongst your adult kids, a moms and dad, a buddy, or even a charity. * In some instances the survivor benefit might not be tax-free, learn when life insurance is taxable.

Term life insurance policy gives protection for a certain amount of time, or "term" of years. If the guaranteed individual passes away within the "term" of the policy and the policy is still effective (active), after that the death benefit is paid out to the beneficiary. 45 term life advanced insurance. This sort of insurance coverage generally enables clients to originally buy more insurance coverage for less cash (costs) than other kinds of life insurance coverage

Life insurance acts as a replacement for income. The prospective danger of losing that gaining power revenues you'll need to money your family members's largest goals like getting a home, paying for your kids' education, lowering financial debt, saving for retired life, etc.

Child Term Rider Life Insurance

Term life is the simplest kind of life insurance coverage. If you buy term life insurance at a more youthful age, you can generally purchase more at a reduced cost.

Term insurance policy is preferably fit to cover particular demands that might lower or disappear over time Adhering to are 2 typical provisions of term insurance policies you may wish to think about throughout the purchase of a term life insurance policy plan. enables the guaranteed to renew the plan without having to show insurability.

Before they provide you a policy, the carrier requires to assess exactly how much of a danger you are to guarantee. Specific pastimes like scuba diving are considered risky to your health and wellness, and that might increase rates.

Lenders That Accept Term Life Insurance As Collateral

The prices linked with term life insurance costs can vary based upon these variables - term life insurance cincinnati. You require to select a term length: Among the greatest inquiries to ask on your own is, "Just how long do I need insurance coverage for?" If you have kids, a preferred general rule is to pick a term enough time to see them outdoors and with college

1Name your recipients: That gets the benefit when you pass away? You might pick to leave some or all of your advantages to a trust, a philanthropic organization, or even a buddy.

Consider Utilizing the dollar formula: dollar stands for Debt, Income, Home Mortgage, and Education and learning. Overall your financial debts, home mortgage, and university costs, plus your income for the variety of years your household requires defense (e.g., until the children are out of your home), which's your insurance coverage need. Some monetary experts determine the quantity you require utilizing the Human Life Worth ideology, which is your life time income potential what you're gaining now, and what you expect to gain in the future.

One way to do that is to seek business with strong Monetary strength rankings. 8A company that finances its own plans: Some firms can market plans from another insurance provider, and this can include an additional layer if you wish to alter your policy or down the roadway when your family members requires a payment.

Some companies provide this on a year-to-year basis and while you can expect your rates to rise significantly, it might deserve it for your survivors. One more way to compare insurer is by considering online consumer testimonials. While these aren't most likely to tell you a lot regarding a firm's economic stability, it can inform you how simple they are to work with, and whether claims servicing is a problem.

Mississippi Term Life Insurance

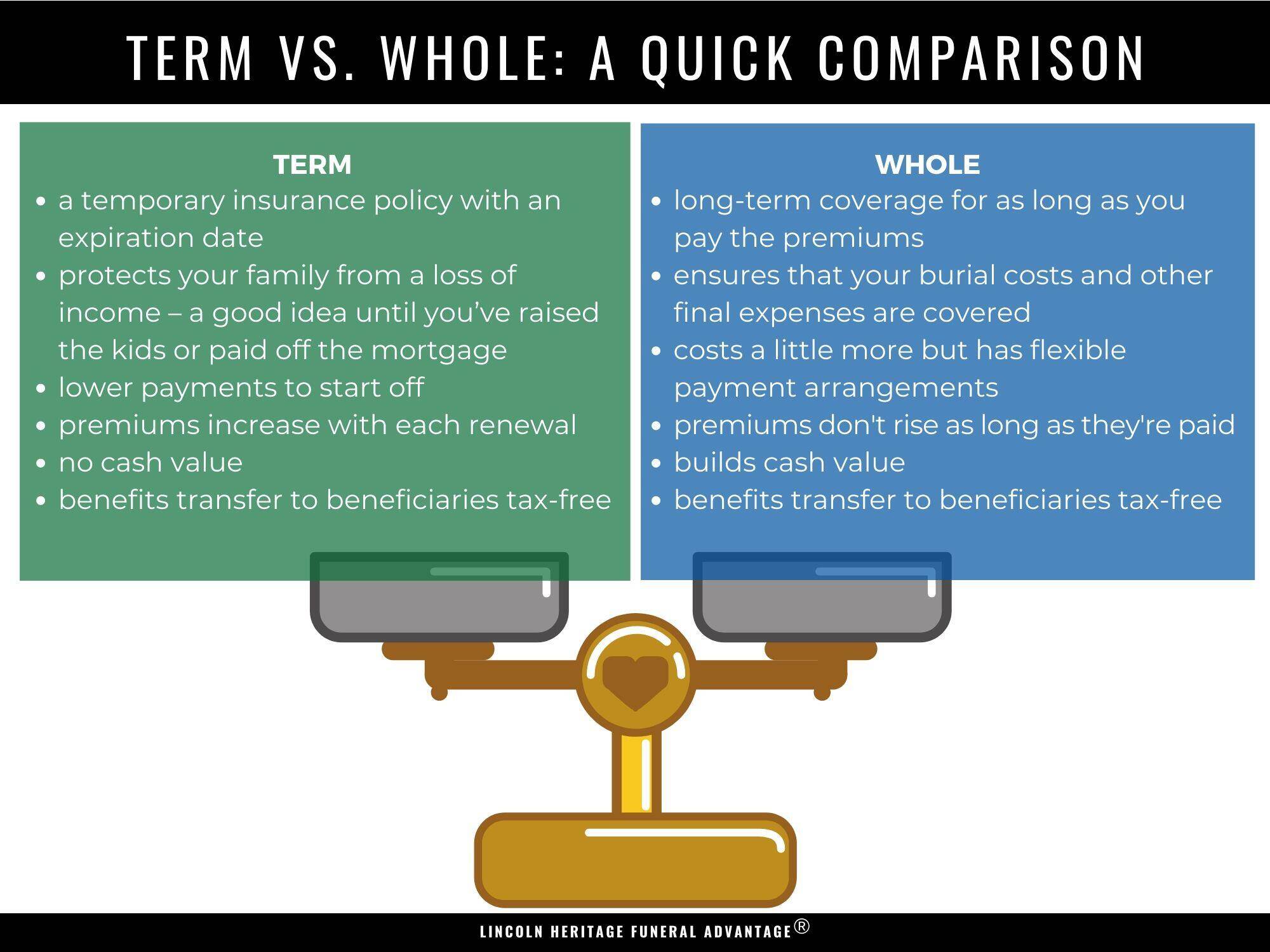

When you're more youthful, term life insurance policy can be an easy method to safeguard your loved ones. As life adjustments your economic priorities can as well, so you may desire to have whole life insurance for its lifetime insurance coverage and additional benefits that you can make use of while you're living. That's where a term conversion can be found in.

Approval is ensured no matter your health. The costs won't enhance when they're set, however they will certainly go up with age, so it's a good idea to lock them in early. Find out more regarding just how a term conversion works.

1Term life insurance policy provides short-term protection for a crucial period of time and is usually more economical than long-term life insurance policy. 2Term conversion guidelines and constraints, such as timing, may apply; for instance, there may be a ten-year conversion opportunity for some items and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Option in New York. There is a price to exercise this biker. Not all taking part plan owners are qualified for rewards.

Latest Posts

Flexible Term Life Insurance

Increasing Term Life Insurance Definition

Which Type Of Life Insurance Policy Combines Term Insurance With An Investment Option?